Tax Newsletter Edition 3

Hello Tax Fans,

Hope everyone is doing great. I will turn back to the OBBB for this edition and probably the next.

The OBBB altered several additional tax provisions (beyond those I covered in Edition 1) that may be of interest to you.

Child tax credit:

Some of you are getting to this stage of life (cue the minivan!). The tax code allows a credit for children, called the Child Tax Credit (CTC), and it was increased on the OBBB. Parents are allowed this credit if they do not make ‘too much money’. The definition of ‘too much’ in this case starts at $200,000 for single filers and $400,000 for married filing joint (MFJ) filers. The credit has two parts in a way. The total credit allowed (in 2025 due to the OBBB) is $2,200 per child (will be indexed for inflation starting in 2026). However, only part of that $2,200 is refundable; in 2025 the maximum refundable credit is $1,700 per child (the refundable part is called the Additional Child Tax Credit, but it is not really additional, the total credit can be no more than $2,200). This credit is not simple (indeed, most tax credits are not simple). It phases-in above earnings of $2,500 (so the taxpayer has to have earned income of at least $2,500) and increases as you earn more, up to a point. The CTC starts phasing-out at the $200k ($400K MFJ) level. The credit will offset the tax you owe. If you qualify for the full credit and the credit exceeds the federal income tax you owe, you could receive up to $1,700 as a refund. Don’t get too wrapped up in the details here, just be aware that if you earn less than or not-too-much-over $200K for a single filer or $400K for a joint filer and you have at least one kid, you should check to see if you should get the CTC.

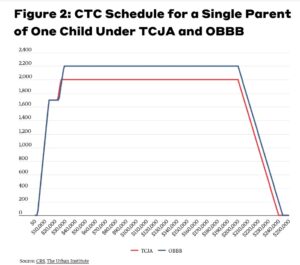

An interesting feature of this credit, and many similar credits for “not rich” taxpayers, are the incentives as a taxpayer phases out. One way to see this is a graph as shown below. This is for a single parent of one child. The blue line is the CTC after the OBBB and the red after the TCJA (both laws made the CTC more generous). What you can see is that after the taxpayer crosses the $200K mark, the benefits start declining rapidly. In this case the limits are at somewhat high income levels so might not affect the incentives to work, but this type of picture also applies to other credits at lower income levels and can lead one to question whether the correct incentives are in place? (graph is from the Bipartisan Policy Center – y axis is the amount of CTC and the X axis is the amount of income for the taxpayer)

Charitable Deduction Limits and Overall Itemized Deduction Limits

The TCJA went a long way towards simplifying the tax code for individuals. The OBBB introduced more complexities and reversed some of the simplification benefits that were in the TCJA.

In Edition 1, I discussed how non-itemizers can now deduct a small amount of charitable donations. This is taxpayer friendly but also increases complexity slightly. For itemizers, new limits are now in place that are taxpayer unfriendly and will significantly increase complexity. There were limits at the top end before -- the TCJA set the limit for cash contributions to 60% (non-cash to 35%) of adjusted gross income. Those limits are still in place. Now, in the OBBB, there is also a floor. The charitable deduction is only allowed for charitable contributions to the extent they exceed 0.5% of the taxpayer’s adjusted gross income. If you are a person that makes large charitable contributions, you may want to consider accelerating your donations to 2025 (but check all the other items this could affect).

The TCJA suspended an overall cap on itemized deductions. The OBBB put one back in (though not the same computation). The rules are a little tedious, but essentially for taxpayers in the top marginal tax bracket (37%), the financial benefit of their itemized deductions will be capped at a 35% tax rate. This applies to most itemized deductions, including charitable contributions and mortgage interest. [For readers interested in the details, the formula operates to reduce itemized deductions by 2/37ths of the lesser of 1) the taxpayer's total itemized deductions, or 2) the amount that their taxable income (including itemized deductions) exceeds the threshold for the 37% tax bracket. ] I wouldn’t sweat the details too much, but please realize that if you are an itemizer, your deductions could be limited if you are a high-income taxpayer. Thus, when you add up your itemized deductions, the total allowed by TurboTax (the IRS) could be something smaller than the total you obtain by simple addition.

That is probably enough for today. If you didn’t get the first two editions, you can find them here.

Hope this is helpful to you! (Remember this is not official tax advice!)

Michelle