Latest Edition of the Tax Newsletter

“The first $100,000 is a b****, but you gotta do it. I don’t care what you have to do — if it means walking everywhere

and not eating anything that wasn’t purchased with a coupon, find a way to get your hands on $100,000. After that, you can ease off the gas a little bit.”

--- Charlie Munger

Hi Former 15.518ers –

I hope you all had a very nice holiday break. For some reason over my Christmas break I was reminded of the above quote. I thought it would be a good fit for my planned topic of retirement savings. It is the end of the year and a good time for each of us to evaluate our financial situation. In addition, in a few days, it will be a good time for some 2026 financial resolutions!

For those of you who do not know, Munger was an accomplished lawyer, investor, and also Warren Buffett’s right-hand man until he (Munger) passed away. He said that quote sometime in the 1990s, so the dollar figure would be higher now – probably something like $200,000 - $250,000. But really there is nothing precise about the dollar amount, he just means some amount that is reasonably large.

At a very basic level think about the case where you have $5,000 saved. Let’s say you earn a 10% annual return (just for round numbers and easy math). In that case, you earn $500/year. If instead you have $100,000 saved, a 10% return will generate $10,000/year. The higher the base, the more your money works for you and the faster your wealth builds.

Also, you should start saving early. The earlier you save the better.

Let’s say you start to save for retirement when you are 25 years old. Let’s assume you stash away $1,000/month and you plan to retire at 65 years old. Assume that you earn on average a 7% annual return (and for ease, let’s just compound annually à $12K/year @7%). At age 65, you will have roughly $2.4 million saved. If, however, you wait until you are 35 to start saving the same $12,000/year, you will only have $1.1 million at age 65. To get to $2.4 million if you start at age 35, you would need to save roughly $24,500/year. (Sure, your income will likely be higher at 35 than at 25 but the demands on that income are also higher for most people…kids, bigger house for the kids, club soccer/volleyball/hockey/baseball/softball for the kids, etc. etc., so saving more money later is not generally easier for most people.)

The bottom line of what Munger was getting us to be aware of is the magic of compounding. So start early and get to a high base as fast as you can. There is also some psychology here as well. If you can get in the habit of spending less than you make, and engaging in steady, disciplined savings, you will probably have the mindset to continue doing so.

With that in mind, how much should we all be saving for retirement? This depends on your health, your spending habits, your plans for retirement (lots of travel?), and other factors (will you inherit a large sum? (don’t bank on that too much); will your kids be financially self-sufficient? (don’t bank on that too much either!)). Financial advisors often say some rule of thumb, like you should have 10X – 12X your annual income in savings by the time you retire. However, none of us have the main, key piece of information that we need to do this calculation. Why not? Because we do not know our future date of death (thankfully), so we do not know how long we will be retired, or if we will live long enough to retire at all for that matter. As a result, you need to insure against mortality, in other words dying young (with life insurance), and you need to insure against longevity (with retirement savings).

There are many sources of information about the average retirement savings by age or by income that some of you might find interesting. Here is one set of data from Fidelity; another about the high-income crowd is here. Some common rules of thumb, like the one mentioned above, are discussed in this article from T.RowePrice (really what you want to shoot for is sufficient income during retirement not a balance at retirement per se, but like I said the ‘12X your annual income in savings’ is a simplified rule of thumb). Looking at how much others have saved is hard to do, and in my opinion not completely helpful. The view into other people’s entire financial picture might be limited, so the stats in those articles are measured with error. Further, if everyone is under-saved, it probably should not make us feel better even if we are doing slightly better than the average. The best thing to do is focus on your own situation given your own facts and circumstances, and then adjust as needed as you proceed through life.

The next question is how to save, or in other words, what savings vehicle to use. This harkens back to 15.518 (Chapter 3). I will cover this topic in two (or 3) editions and expand on what we did in class. In this edition, I will cover the Roth vs Traditional decision for your basic workplace defined contribution retirement savings plans – 401(k) plans (at for-profit businesses) or 403(b) plans (if you work at a non-profit, a public school, a church, etc.). The Roth vs Traditional choice is a decision almost all of you likely make every year. Your employer offers these types of savings accounts and allows you to choose whether you want a Roth or a Traditional-type of account. You can change your choice year-to-year or even part way through a year. (In the next edition(s) I will discuss IRA accounts and self-employed retirement savings options.)

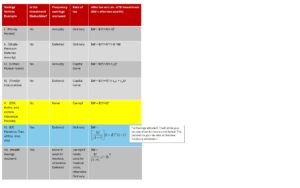

Using the chart from class (the textbook), the Roth is Savings Vehicle V (in yellow below) and the Traditional is Savings Vehicle VI (in blue below). Remember that I in these formulas represents the after-tax cost of the investment. To accurately compare across the investments, that I needs to be the same in each one. (R = the pre-tax rate of return; t = your tax rate; n = number of years).

Recall that both of these types of accounts – Traditional or Roth 401(k)s (or 403(b)s) - are Defined Contribution plans, meaning that the contributions are defined (you declare that you will save a set percentage of your income per year) but the benefits are not defined: you bear the risk in terms of investment returns. There are limits and rules that I will cover to some degree below but the key features are as follows. As you contribute money each year, your wealth grows according to the table and the formulas on the right. For a Roth-type account (yellow, SV 5), you contribute after-tax dollars (meaning you pay tax on that income and then contribute into the account (column 2 is a No)), the funds grow without an annual tax on the earnings (column 3), and when you withdraw the funds there is no tax on the withdrawals of contributions or the earnings (there is no t in the formula to the right!). The account is tax-free (after you pay the tax on the dollars you invest). In contrast, in a Traditional-type account, you contribute pre-tax dollars. How this is operationalized for a Traditional 401(k) account is that your employer will contribute a portion of your pay every pay period into the 401(k) account. When you get your W-2 form at the end of the year telling you what to report on your tax return, Box 1 for Wages will not include the amount your employer contributed on your behalf to the Traditional 401(k) account (in contrast, if you choose the Roth 401(k) account, Box 1 will include the amount the employer contributed on your behalf because in a Roth the contributions are made with already taxed earnings).

So, which should you choose? Here are the general guidelines. (Remember that nothing I write in these newsletters is official tax or investment advice.)

- If your marginal tax rate is lower now than it will be when you retire, then a Roth will dominate the Traditional. Basically, you are choosing to tax the contributions now at your low rate, but then the earnings are tax-free when withdrawn at your then-higher-tax rate.

- If your marginal tax rate is higher now than it will be when you retire, then a Traditional will generally dominate the Roth. Basically, you are deducting the contributions when your tax rate is high and subjecting the withdrawals to tax when your tax rate is low. This is a great deal it turns out and this is ‘normally’ how retirement income has been viewed…you are in a high tax bracket when you are working (especially in peak earnings years, your 40s – 50s, and now also your 60s for many). Then when you retire your income goes down. However, it doesn’t really pan out that way sometimes for high-income earners because you will likely have so much saved you are still in a high bracket when you retire. Also, there is a fear with the government debt being so high, that tax rates will have to rise in the future.

When you were students, I said go Roth because when you are a student your tax rate is low (unless you had a working spouse with high income). If you know for sure your tax rate is lower now than it will be when you retire, a Roth is the clear winner. But when you are working it is harder to predict what direction your tax rate will go. No one really knows for sure, so as a basic premise a portfolio that is diversified in terms of tax treatment – some Roth and some Traditional – might be a good idea.

On a more detailed level, if you are interested, note the following:

- What you will notice looking at the math above is that if your t remains the same over time, then the Roth and the Traditional yield the same after-tax wealth. Using algebra the (1-t) cancel each other out in the Traditional formula if t is the same when you contribute as when you withdraw. In that case, the Traditional formula is the same as the Roth. That is counterintuitive to many, but it is true (but only when you contribute below the contribution limits (discussed more below)). The majority of the decision of a Roth versus a Traditional is a bet about your tax rate. Will your rate go up or go down in your retirement years versus your working years?

- The pre-tax versus post-tax nature of the contributions can be seen in the math above. The Roth just has an I, but the Traditional account formula has an I/(1-t). That means that to compare these correctly, you take the after-tax cost of the investment that you would have made to the Roth (so your computations are comparable) and divide by (1-t) where t is your tax rate. This yields the amount of physical dollars that you must invest when you choose Traditional in order to make the original investment economically equivalent to (the after-tax cost the same as) the Roth investment. This is just to be able to correctly compare them for decision making purposes (it is not a requirement of the tax law).

- There is one complication to all of this, and it is important…the complication occurs when you are contributing at the limit of these accounts, then you have to consider that issue explicitly. For 2026, the employee contribution limit is $24,500 (with some exceptions I will not cover here). One way to think about this is as follows. If you contribute the full $24,500 into the Roth 401(k) account, then your employer will withhold that amount from your pay over the course of the year (or however fast you tell them to do it), and deposit it into your 401(k) account. At the end of the year, your W-2, Box 1 will show your total wages, including the $24,500 and you will pay tax on that amount in the current year. But what about the Traditional account? Let’s say you tell your employer that you want to put $24,500 into a Traditional 401(k) account instead of the Roth. The employer will withhold $24,500 throughout the year (or however fast you tell them to do it) and contribute that to a Traditional 401(k) account. Now, on your W-2 form at the end of the year, Box 1 will be your total wages LESS the $24,500. The $24,500 is not taxed in the current year. Let’s say your tax rate is 30% in 2026. Thus, you will pay $7,350 less in taxes ($24,500*.30) in 2026 if you contribute $24,500 to the Traditional 401(k) relative to if you would have invested the same amount in the Roth 401(k). Thus, that contribution is NOT economically the same (even though you put $24,500 physical dollars into either account). To compare the two investments properly, you have to consider what you do with the $7,350 tax savings of the Traditional option. You cannot put it into the Traditional 401(k) because you are at the IRS limit (in other words, your I for the Traditional account is only really $17,150 – it is not the same as the Roth so directly comparing them is inaccurate in this case unless you also take into account what you do with the $7,350). Most people do not consider this and just spend the tax savings from the Traditional. This is why sometimes you will hear people refer to a Roth as ‘forced savings’ because you put the full $24,500 in and you have to pay the tax on that when it goes in so you are forced to save more.

- There is another benefit to Roth accounts as well. Roth 401(k)s do not have required minimum distributions (RMDs) for the original account owner (this rule was put into place in the SECURE 2.0 Act). RMDs are required distributions from the account once the owner reaches age 73 (that is scheduled to change to 75 in 2033). Traditional 401(k)s and Traditional IRAs have RMDs, but Roth accounts do not. Thus, the Roth versions allow tax-free compounding to continue longer, offering greater flexibility and tax-free income in retirement. So, if you think you will live a long time OR if you desire to make sure to leave some of your retirement accounts for your kids, then the Roths are attractive because they do not require you to take distributions. (Note though that inherited retirement accounts have distribution requirements so the tax deferral cannot go on forever).

- Two final issues. First, many employers offer some level of matching when you contribute. You can read more about that here. Make sure you contribute at least enough to get the full match (and most of you should be contributing much more). A new-ish rule is that when an employer matches into a Roth 401(k), that match amount is taxable to you when the employer match contribution is made. Second, ‘catch-up’ contributions are allowed. For 2026 if you are over 50 you can contribute an extra $8,000 (and if your plan allows it, for ages 60-63 an additional $3,250 on top of the $8,000). A major change effective January 1, 2026 is that for ‘high-income’ earners (over $150K for 2026) any catch-up contribution must be made to a Roth-type account.

Hope this is helpful to everyone and motivates you to save more in 2026!

Happy New Year!

Michelle